今日分享

Today's Share

成功其实很简单,就是当你快扛不住的时候,再坚持一下。

Success is actually simple-when you are about to fail to hold ,hang on a bit long.

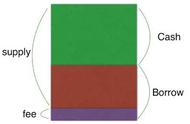

利率的组成

Composition of interest rate

利率是资金的“价格”,由市场上资金的供给与需求决定。从投资者的角度去看,投资者对利率的预期等于实际利率加上四种类型的溢价补偿。

Interest rate is the "price" of funds, which is determined by the supply and demand of funds in the market. From the investor's point of view, the investor's expectation of interest rate is equal to the real interest rate plus four types of premium compensation.

利率=实际无风险利率 预期通货膨胀利率 违约风险溢价 流动性风险溢价 期限风险溢价

Interest Rate = Real Riskless Rate Expected Inflation Rate Default Risk Premium Liquidity Risk Premium Term Risk Premium

1、实际无风险利率(Real risk-free interest rate )

实际无风险是指单期内不考虑预期通胀下无风险资产的收益率。从经济学上看,实际利率反映了投资者对当前消费与未来消费的偏好。

Real risk-free rate means the return rate of risk-free assets in a single period without considering expected inflation. Economically, real interest rates reflect investors'preferences for current and future consumption.

2、通货膨胀溢价(Inflation Premium )

通货膨胀率溢价是指用于补偿预期通货膨胀率的溢价部分。通货膨胀会减少单位货币的实际购买力,因而必须在实际利率基础上加上通货膨胀溢价以补偿投资者购买力的损失。

Inflation premium refers to the premium part used to compensate for the expected inflation rate. Inflation reduces the real purchasing power of a unit currency. Therefore, an inflation premium must be added to the real interest rate to compensate for the loss of the purchasing power of investors.

对于投资者来说,如果投资风险资产仅能获得名义无风险收益率的话,该风险资产是没有吸引力的,不如直接将钱存进银行,风险资产的收益率必须补偿投资者承担的相应风险。风险按照类型可以分为违约风险、流动性风险、以及期限风险三种

For investors, if only nominal risk-free rate of return can be obtained, the risky assets are not attractive. It is better to deposit money directly in the bank. The rate of return of risky assets must compensate for the

corresponding risks that investors bear. Risks can be classified into three types: default risk, liquidity risk and term risk.

3、违约风险溢价(Default risk premium)

违约风险溢价:补偿投资者承担的违约风险,即借款方到期无法按合约支付收益的风险

Default Risk Premium: To compensate investors for default risk, i.e. the risk that the borrower will not be able to pay the return on the contract at maturity.

4、流动性风险溢价(Liquidity premium )

流动性风险是指短期内无法将资产按照市场公允价值迅速变现的损失。对于一些流动性较差的资产,若要迅速变现就不得不折价出售。例如房地产,以及交易量很小的小盘股\期货等金融资产

Liquidity risk refers to the loss that can not be realized quickly according to the fair value of the market in the short term. For some assets with poor liquidity, they have to be sold at a discount if they are to be realized quickly. For example, real estate, as well as small-cap stocks, futures and other financial assets with small trading volume.

5、期限风险溢价(Maturity Premium)

期限(Maturity)是指距离到期支付本金的时间,通俗的讲,投资债券相当于借钱给他人,约定还钱的时间越久,自然要求借款人支付越高的利息,以补偿期限风险。例如多数情况下长期国债的利率是高于短期国债的。

Maturity refers to the time when the principal is due to be paid. Generally speaking, investment bonds are equivalent to lending money to others. The longer the agreed repayment time is, the higher interest the borrower will naturally be required to pay to compensate for the term risk. For example, in most cases the interest rate of long-term treasury bonds is higher than that of short-term treasury bonds.

内容来源于网络公开信息。

风险提示:本文仅作为知识分享,不构成任何投资建议,对内容的准确与完整不做承诺与保障。过往表现不代表未来业绩,投资可能带来本金损失;任何人据此做出投资决策,风险自担。如有侵权请联系我们,我们将及时处理。

The content comes from publicly available information on the Internet.Risk tip: this article is only for knowledge sharing, does not constitute any investment advice, and does not promise and guarantee the accuracy and integrity of the content.Past performance is not indicative of future performance and investment may result in principal loss;Anyone makes an investment decision based on this, at their own risk.If there is any infringement, please contact us and we will deal with it in time.